What would happen if your friend borrows your auto, are you covered?

This is a question we receive in our office often.

Let’s face it. Life happens. You’re at your friend Teddy’s parked at the end of his driveway behind four other people. Teddy can’t wait for tacos, so he’s taking your truck to pick them up.

Or your Mom is babysitting at your house. You tell her she can use your car if she needs to take the kids somewhere.

When you give someone permission to use your auto, know that insurance follows the car, not the driver. So the answer would be yes, you would be covered if you let someone drive your vehicle.

Just know that you could still be liable if an accident occurs. Any time you allow someone to drive your vehicle, you’re also lending your car insurance.

Liability

The Liability portion of your auto insurance would pay for someone else’s injuries and/or damage to their auto. Understand, if the person driving your auto maxes out your Liability limits, you may be held responsible for the financial implications.

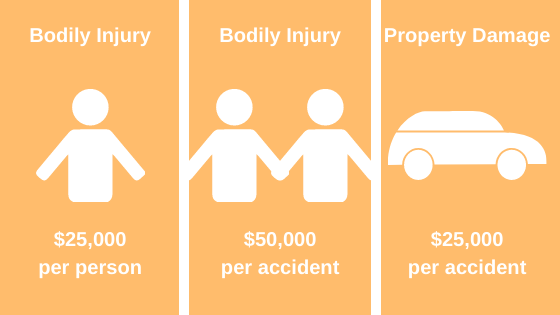

Below is a quick illustration of your auto Liability insurance. You will have a

- Per Person Limit

- Per Accident Limit (i.e. the most your policy will pay if multiple people are injured).

- Property Damage Limit (damage to someone else’s auto, a fence, guardrail, light pole, etc.)

Physical Damage to Your Auto

When if comes to repairing or replacing your auto due to an accident, you would need Comprehensive or Collision coverage (depending on the accident) to apply. If you do not have Comprehensive or Collision coverage you will be responsible for paying for the damage.

If your friend causes an accident, you will have to file the claim with your insurance company.

Your friend’s car insurance company may also have to step in and pay for damages too.