I am sure almost all of us have seen the commercials on TV.

We can insure you today.

We’ll insure you for state minimum limits only.

We won’t sell you more than what you need.

However, in the commercials they don’t go on to explain exactly what state (Missouri) minimum limits are (unless maybe it’s in the fine micro print at the end that scrolls through faster than any average person can read) and I doubt they explain it to you when you buy the policy either.

What Does Auto Liability Insurance Cover?

So today, I’m going to take the time to explain to you about what the numbers are on your auto liability insurance policy actually mean.

Then it’s my hope as an educated consumer you can make a better informed decision about how much coverage you need to purchase.

That way, when you crash into my car I know I will be taken care of!

Bodily Injury Liability

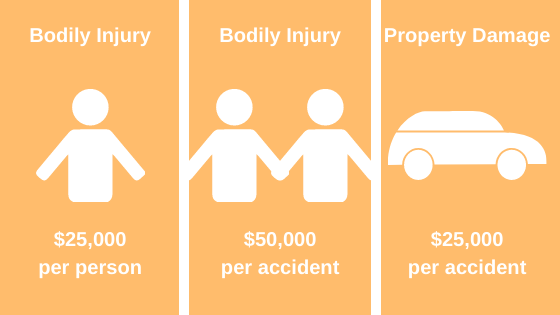

The first type of coverage is Bodily Injury Liability.

It has a per person sublimit as well as an each accident total limit.

Clear as mud right?

This dollar amount is the total amount your policy will pay for a person you injure with your vehicle. It would pay for, but not limited to, ambulance bills, hospital bills and pain and suffering.

Per Person Limit

Per person means for each individual you hit in a single accident. (If you cause a five car pileup again tomorrow – your limits will start over fresh.)

State law requires you to carry $25,000 Bodily Injury per person. At first glance this may seem like a lot, but have you been to the hospital lately? Those bills add up fast.

Let’s say you hit a person crossing the street and break their leg – not both legs, just one. They require surgery and a 3 day hospital stay. That $25,000 isn’t going to cover the bill. Let alone if you are responsible for an accident where someone has to be life-flighted, spends 3 months in ICU and isn’t expected to ever make a full recovery.

Your insurance company is going to pay that $25,000 in full and walk away – leaving you with the balance.

They’ve done their part, they provided you with the coverage you purchased.

The Bodily Injury Liability coverage also has an each accident total limit.

Each Accident Total Limit

State Minimum is $50,000. This will pay out for as many people as necessary (up to the per person limit) up to the total limit. Again, $50,000 may seem like a lot, but what if you hit a school bus filled with 50 children. If all of them are only minorly injured that’s only $1,000 a child.

We won’t even talk about if you would happen to cause a 5 car pileup.

Your $50,000 could be gone in a blink of an eye. Literally.

Property Damage Liability

The final coverage we’re going to look at today is the Property Damage Liability limit.

This is what pays for any damage to someone else’s property you may cause, whether it’s another vehicle, a house or a tractor.

State requirements come up short here again. They only require $25,000 in coverage.

Everyone is familiar with the term totaling a vehicle. When the insurance adjuster decides there is more damage to your vehicle than what it is worth, so they give you a check and you buy a new vehicle instead of fixing yours.

Now imagine you just totaled someone else’s vehicle.

There are a whole lot of cars on the road today that are worth more than $25,000.

A WHOLE lot.

You see the cars on the news crashing into people’s houses and tearing up entire walls – good luck finding a contractor to fix that damage for $25,000.

Back to the 5 car pileup – let’s hope the one you cause includes a lot of old cars going slow on a side street through town. Because you are only going to average $5,000 a car to fix the damages.

Have you been to a body shop recently?

Final Thoughts

The scary thing is there are actual people out there driving around with these coverages and they are doing it legally.

I just hope they don’t hit me (or you) because you’re not going to be happy with what their insurance company pays you. But in reality the insurance company is doing their job. They are performing as they promised.

It’s just the consumer that bought the subpar policy. Now I can’t tell you how much coverage to purchase, because I don’t know what kind of accident you might cause in the future – my crystal ball just isn’t that good (I wish it was, I could be rich).

But ask yourself, what do you have to lose?

This includes any current assets as well as your future potential earnings (they can actually garnish your wages). You can often double or triple your limits for as little as $5.00 a month.

Hopefully you are never in an accident, but if you are, the higher auto liability limits are worth the peace of mind to know that you won’t be getting bills in the mail after your insurance company has paid their part.