Michael Jordan or LeBron James? Should Major League Baseball get rid of the Designated Hitter Term Life Life or Whole Life Insurance. These debates could go on for days. When it comes to life insurance, what’s best of millennials?

What if it’s not really a debate at all and more a question of, “what are your goals?” What are you trying to achieve?

First we need to ask ourselves; why is life insurance worth it?

Quick Guide

- Why Spend Money on Life Insurance?

- What is Term Life Insurance?

- Benefits of Term Life Insurance

- What is Whole Life Insurance?

- Benefits of Whole Life Insurance

- Term versus Whole Life Cost Comparison

- What’s Best for Millennials?

Why Spend Money on Life Insurance?

You have enough expenses as it is, why add one more?

For starters, you don’t buy life insurance for yourself. You buy it for your family. The people at home that depend on you.

If you don’t come home tonight, how would that impact your family’s finances?

Life insurance is an action. It is an act of love. Life insurance should be renamed Love Insurance.

Second; have you OR are you planning to:

- Buy a house?

- Purchase a new car?

- Have a baby?

- Go on vacation?

- Save for your kids future education?

- Invest for your retirement?

All of those things require a plan, whether you realize it or not. We’re not talking anything complicated. How will you save enough for a down payment to buy a home? How long will it take you to have enough for retirement?

The challenge with insurance is you can’t touch it. Moreover, when it comes to life insurance, no one wants to face their own mortality.

For instance, when you buy a new vehicle or see your child receive their diploma you get to reap the fruits of your labor. There is a satisfaction that comes with these types of goals that you planned for.

Yet when it comes to insurance, you make the purchase reluctantly. You cringe at the idea of spending money on something you don’t want and hope you never need.

How would you live in your home on one income? Is that a viable option?

Life insurance isn’t near as much fun to plan for as retirement or buying a new car, but it is a necessity.

Let’s dive in and look at both Term Life Insurance and Whole Life. What’s best for millennials?

What is Term Life Insurance?

I imagine if you are reading this you’re in your 20’s, 30’s, or maybe even your 40’s.

You may be married (or in a longterm relationship).

Some of you have kids.

Most probably have some form of debt (auto loan, mortgage, student loans, business loan).

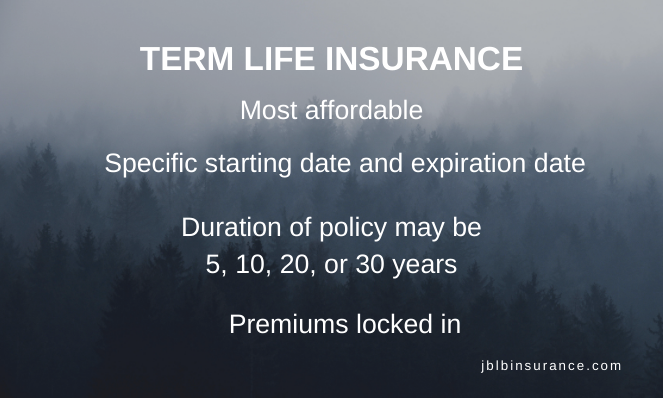

Term Life Insurance policies come in a specific term. Generally a 10, 20, and 30 year time span.

Let’s say you are 28 years old right now. You choose to purchase a 30 year Term policy. At age 58 the policy will expire (providing you are still living).

The idea behind Term Life Insurance is it will replace your income and take care of your family’s temporary needs if you are no longer in the picture. Temporary needs may be paying off your home and/or replace your income.

Using the example above, at age 58 your kids have moved out of your home. You have paid off your mortgage. Plus you have a nice savings stashed away. Life insurance may not be necessary for you anymore (if anything, your needs have changed).

Understand, Term Life Insurance will only pay if you pass away. The money would go to your Beneficiary (i.e. the person(s) of your choice).

Benefits of Term Life Insurance

The beauty of Term Life Insurance is how straightforward it is. Let’s looks at 6 benefits to Term Life Insurance for millennials.

Level Premium: Whether you buy a 10 year or 30 year Term, the premium is locked in for the duration of the Term.

Death Benefit: Should you pass away during the Term, your Beneficiary would receive the Face Amount of the policy. For example, if you have a $500,000 Term Life policy, the $500,000 is the Face Amount. That is what your Beneficiary would receive.

Least Expensive: Yep, it’s no secret. Term Life Insurance is the least expensive type of life insurance.

Convertible: No, you can’t put the top down. However, you may convert a Term policy to a Whole Life policy prior to the Term policy expiring.

Temporary Needs: Term Life Insurance is designed to protect temporary needs. Your home loan won’t last forever, your kids will eventually move-out (hopefully). If the worst case scenario happens, Term Insurance fills the financial void. Ideally, when those temporary needs are no longer there, the policy would not be necessary.

Simple to Understand: Term Life Insurance is the simplest form of life insurance to grasp. It has a very clear objective.

What is Whole Life Insurance?

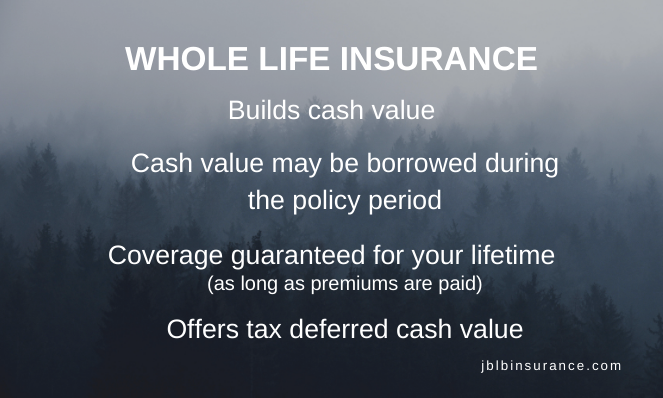

Whole Life Insurance is in the family of Permanent Life Insurance. Providing you pay the premium, a Whole Life policy will be with you your entire life. Most policies are designed to last to age 100 (or longer depending on the insurance company).

Whole Life policies have a cash value piece that Term Life does not. Think about how a savings account works. When you put money into it, it accrues interest. Cash Value in a Whole Life policy generally receives a guaranteed interest rate. The money grows slowly overtime.

Once your policy has enough Cash Value you can Borrow from the policy. Be aware, if you Borrow from your Whole Life Insurance policy you will lower the Death Benefit (i.e. the amount your Beneficiary will receive when you pass away).

Be aware; your Beneficiary won’t receive the Face Amount plus Cash Value when you pass away. They only receive the Face Amount. Cash Value is a living benefit to Whole Life Insurance.

Remember the Face Amount of the policy is the amount of coverage your policy is for (example: your policy is a $100,000 Whole Life policy). Cash Value is the investment piece of the policy that accrues interest overtime.

Another thing to note; when you Borrow from your Whole Life policy, you will be charged interest when repaying the loan.

Should you Surrender the policy (i.e. cancel the policy), you will receive a check for the Cash Value. Keep in mind, this means you no longer have life insurance.

Whole does tend to be more complex than Term Life.

The nice thing is if you buy a Whole Life policy at age 35, the premium will be the same at age 70. Where if you purchased the same policy at age 70 it would be substantially higher (due to your age and possibly health concerns).

Benefits of Whole Life Insurance

What are the benefits of Whole Life Insurance?

Level Premium: Premiums won’t teeter. They will stay the same the life of the policy.

Cash Value: Similar to a savings account, the value will grow with time (this doesn’t happen overnight).

Borrow From Policy: Whole Life is unique because it gives you the ability to Borrow the Cash Value from your policy once it reaches a certain level in value.

Surrender: Cancel your policy and you receive the Cash Value available.

Term versus Whole Life Cost Comparison

The chart below is a comparison between a 30, 20, and 10 year Term and a Whole Life policy for both male and female. All of the numbers in the chart are based on the following info:

- Face Amount: $500,000

- Insurance Company: Cincinnati Life Insurance

- Figures below are based on good health, non-smoker.

- All premiums below are annual premiums.

| GENDER | AGE | 30 YEAR TERM | 20 YEAR TERM | 10 YEAR TERM | WHOLE LIFE |

|---|---|---|---|---|---|

| Male | 25 | $445 | $300 | $265 | $2,965 |

| Male | 35 | $525 | $365 | $270 | $4,345 |

| Male | 45 | $1,215 | $750 | $475 | $6,675 |

| Female | 25 | $320 | $230 | $205 | $2,635 |

| Female | 35 | $440 | $315 | $245 | $3,800 |

| Female | 45 | $940 | $605 | $385 | $5,750 |

Scenario 1

Looking at the chart above, a 35 year old male would save $3,820 per year by purchasing a 30 Year, $500,000 Term policy versus a $500,000 Whole Life policy.

Let’s say the price isn’t a problem, you can afford the $500,000 Whole Life policy. However, you want to get the most out of your money. What if you considered buying the Term policy and investing the difference in the form of retirement (401K, Roth IRA, etc)?

The Cash Value in a Whole Life policy may get 4.5% interest. I’m not a financial planner, but I imagine you could an 8% return by investing that money in a retirement account.

Scenario 2

Maybe you don’t have $4,000 per year to play with. Let’s say your budget is a little tighter, but you realize you need life insurance. You’re a 35 year old male, good health, non-smoker.

A 30 year, $100,000 Term Life policy would be $30.42 per month.

A $100,000 Whole Life policy would be $81.81 per month.

The 30 Year Term provides a savings of

- $51.39 per month

- $616.68 per year

- $18,005.40 over 30 years (the life of a 30 year Term policy)

That’s money that could be working for you. Whether you want to invest it, put it in savings, pay extra on a loan…

What’s Best for Millennials?

Growing up I remember my parents telling me to take a jacket, I’ll want it when the sun goes down. Of course I thought I knew more than them. Later that night, I would kick myself for not planning accordingly.

Planning is critical.

“If you fail to plan, you are planning to fail!”

Benjamin Franklin

This is why I am a huge advocate for financial education and financial planning. You don’t know where you’re going without a map.

Ultimately I am a fan of Term Life Insurance.

It is the simplest, least expensive way to protect your family. Given these points, I believe you can use the additional money you would use on Whole Life to put towards another area where your family needs it.

Not everyone reading this will have the discipline to set money aside for savings/investing.

And Whole Life Insurance can have its place.

At the end of the day, you need some form of safeguard in place.

Don’t procrastinate. Let’s get started.